FUNDING READINESS CENTER

Business Funding Overview

Click on the video below for an instructional overview of business funding options. To begin, click on the Readiness Intro tab for an overview of the Funding Readiness Center.

Welcome to the Funding Readiness Center

Welcome to the “Funding Readiness Center” where small businesses seeking outside capital can come to prepare.

We invite you to explore all of the resources and features of the center but encourage you to start with the Readiness Checkup. The Readiness Checkup walks you through the important topics that investors and lenders consider as they review funding applications.

Through a comprehensive series of questions, developed by funding professionals, you will be able to identify where preparation may be needed before you submit a loan application or make an investor pitch. The self-assessment can help identify whether your credit history, financial records, or your business strategy need some attention before you apply. And these are just a few of the areas covered!

To start your funding preparation, first select Readiness Checkup and create a personal account. Then begin your self-assessment by responding "yes" or "no" to each readiness statement. As you progress, you’ll find helpful tips and links to strengthen your funding readiness. Be sure to take time to read or listen to the tips that pop up as you respond to each statement.

As you complete each section, you’ll have the option to stop and email your progress or, to continue to the next topic. A summary of your Readiness Checkup results will be available by email upon completion.

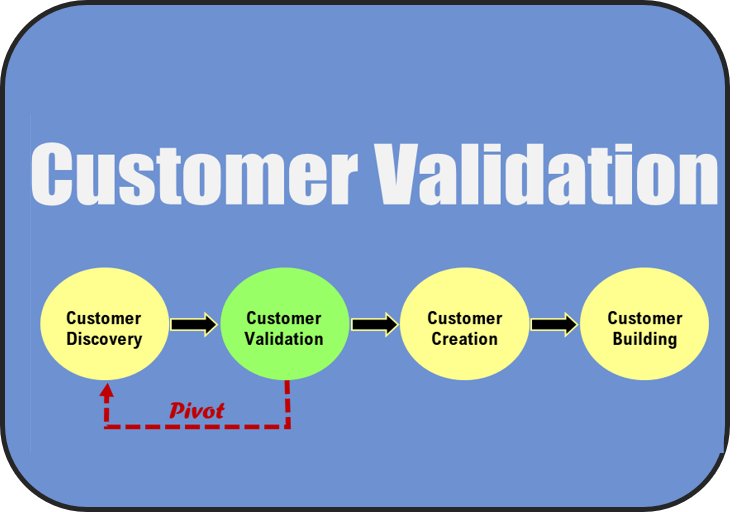

The Funding Readiness Center also provides learning resources and additional guidance to help with your preparation. Select Readiness Training to find more helpful information about budgeting, financial projections, market validation, business planning and more.

Once you've addressed your readiness needs, take time to look at Funding Options. Here you will find descriptions and ratings for the more common funding alternatives.

Commercial loan? Crowdfunding? Revolving credit? Which is best?

Each option varies in cost, timing and the work needed to apply, so look for the one that best fits your current situation.

Also, if you'd like some help narrowing the funding options you may want to consider, choose Funding Selection. By answering a short series of qualifying questions, the Funding Readiness Center can provide a list of options that reflect your funding preferences.

Remember, before you apply for funding, take advantage of the many resources offered here in the Funding Readiness Center.

Are you ready to start? Then just select Readiness Checkup and begin your funding preparation.

Funding Readiness Checkup

Organizations receiving funding applications from you will, in large part, gauge their response on information provided in the areas covered by the Readiness Checkup. By completing the checkup, your preparation will become better-aligned with the expectations of funding organizations. The checkup reveals areas that require attention, and it provides tips to improve your overall funding readiness.

To start, set up a personal account, select a topic and then respond “yes” or “no” to each statement. As you respond, a video icon () may appear indicating the subject needs your attention. Click on the icon and benefit from the information you’ll get. As you complete each section you will notice either a thumbs-up icon (![]() ) or a caution icon (

) or a caution icon (![]() ) which indicates there is pre-application work yet to be done.

) which indicates there is pre-application work yet to be done.

Background Information

Personal Information

Operations & Strategy

Financial Management

Licensing & Legal

Business Taxes

Funding Readiness Training

Find valuable insights and information that will help shore-up areas that need attention before you ask funding providers to consider your application.

Additional Readiness Training

Business Licensing Guide – Florida

Employer Identification Number (EIN)

Individual Taxpayer Identification Number (ITIN)

What are the Funding Options?

There are many funding options available to small businesses today. Each has its own unique features and benefits, and each has its own set of requirements and costs. The Funding Readiness Center has compiled a list of the most common funding options and provided a brief description of each. We've also included a rating system to help you understand the cost (), time frame (), and work () needed to apply for each type of funding.

Traditional Bank Loans

Banks offer several types of commercial loans, including lines of credit, term loans, and balloon notes. The terms of the loan are influenced by several factors, including the amount of the loan, the intended use of the funds, and the applicant’s credit and collateral.

Occasionally, a borrower may be able to obtain an unsecured loan if he or she has great credit and the loan amount is small. For larger loans and for borrowers with satisfactory (but not excellent) credit, banks will likely require some form of collateral for the loan.

Typically, lenders will use business assets for collateral to the extent to which they are available. However, the collateral value of many business assets (such as equipment, furniture/fixtures, or inventory) is low, so the bank will look to the business owner for personal assets to serve as collateral for the loan. Specifically, the bank will ask for equity in real estate or cash equivalent investments such as certificates of deposit as collateral.

Lenders commonly require borrowers to offer the equity in their homes as collateral for business loans, and generally are not interested in jewelry, home furnishings, or personal vehicles.

A good place to start when considering applying for a commercial bank loan is to talk with a bank where you already have an account.

Keep in mind that the bank needs information about your business to make a decision on your loan request. Expect to provide the lender with information about existing business debts and documents such as tax returns, current financial statements (business and personal), and your business plan.

Small Business Administration (SBA) Loans

Small Business Administration-guaranteed loans are not direct loans. Instead, SBA loans are provided through participating financial institutions (bank or non-bank lenders). SBA guarantees, or backs, a portion of the loan to the lender. For an SBA loan, both the lender and SBA consider the borrower’s collateral, credit, equity, and experience, and the history of the business, when making a determination.

Obtaining an SBA-guaranteed loan can take longer than a traditional bank loan. Depending on which SBA program is used, once the lender submits a finalized application to SBA, the turnaround time is typically 10 days or fewer. However, the time involved with getting to that point should also be considered.

First, a borrower must find a lender interested in the project. Then the lender applies to SBA for the guarantee on behalf of the borrower. Specific documentation is required for an SBA loan, and gathering the required documents can be tedious and time-consuming. Therefore, well-organized borrowers will typically move more quickly through the process.

The lender has paperwork to complete as well before the application goes to SBA. ASBTDC recommends that borrowers allow at least 60 days for SBA 7a and 504 loans. SBA Express may require less time.

The lender sets the interest rate that is charged on an SBA loan, but SBA limits the interest rate that that the lender can charge. On loans over $50,000, the interest rate is 2.25% to 2.75% over prime. The cost is higher on loan amounts under $50,000.

In addition, the SBA charges an upfront guaranty fee. The fee depends on the amount of the loan but typically is in the range of 3% to 3.5% of the guaranteed portion of the loan.

Peer-to-Peer (or Network) Lending

Peer lending is a form of funding from individuals who may, or may not, know you personally and are willing to provide funds to help start or advance your business. It can also be a loan where an online platform serves as an intermediary to connect lenders and borrowers and facilitate transactions. Typically these loans are small personal loans and are often unsecured. Rates and amounts available may vary. Persons with better credit would have a lower interest rates, those with average credit see higher rates. In addition, the lending platform typically charges a fee based on a percentage of the loan amount and/or a percentage of the interest paid on the loan. The time to obtain funding can be short relative to many other forms of financing, if your deal is attractive to peers or lenders.

Alternative Online Lenders

There are a growing number of alternative lenders (sometimes referred to as “innovative lenders”) operating online. Many of these lenders target higher-risk borrowers, attracting businesses that cannot get credit through traditional channels, but there are others that compete directly with local lenders for borrowers who are good credit risks. The time it takes to secure funds from an alternative lender will vary based their processes and the attractiveness of the deal. As with traditional banks and credit unions, fee structure and interest rate will vary by lender and project risk. In many cases, this capital tends to be more expensive, especially for customers who are unable to obtain financing through traditional channels.

Alternative Online Brokers

Alternative online loan brokers are a growing source for debt funding. They work to match prospective borrowers with lenders seeking loans of a particular type (capital, inventory, etc.). Many of these loans are short-term loans of less than one year. Some are not actually loans but rather merchant cash advances (see descrition below). The length of time to acquire these funds will vary and the fee structure and interest rate will depend on the amount borrowed and risk of the project. However, this capital tends to be expensive, especially for customers who are unable to obtain financing through traditional channels. Loan broker sites add an additional fee to those charged by the actual lender.

Merchant Cash Advances

A merchant cash advance is funding provided to businesses in exchange for a percentage of daily credit card sales. While this form of capital can be a quicker option than a conventional loan, the cost is typically very high and gross profit margins will be impacted. A merchant cash advance can be obtained in as little as a few days to a week. When stated in terms of annual interest rate, the cost of a merchant cash advance can be sky high. Be sure to inquire about the estimated APR on any funds advanced to get a clear picture of the actual cost of capital.

Invoice Factoring

Invoice Factoring is a unique type of funding where a business sells an accounts receivable balance for cash at a discount on the book value. Essentially, the business sells the receivables at an amount less than the value of the receivables. The factoring company is repaid upon collection. When the receivables are collected, the funds are repaid to the financing company. Invoice factoring applications can be approved in as little as a few days. The actual cost of funding acquired in this way is equivalent to the discount at which you sell the receivables.

Invoice Financing

Invoice financing can be a very quick and sensible source of funding to cover short term operating expenses. Instead of letting unpaid invoices collect dust and hinder your business, you can use an invoice financing service to advance payments on outstanding invoices. Invoice Financing is where a lender provides a company with up to 90% of the value of its unpaid invoices up-front in the form of a loan. The loan is settled, or repaid, when the respective invoices are paid. A fee of approximately 3% is typically charged by lenders for this type of funding.

Microloans

Microloan is a general term used for small commercial loans that are typically less than $50,000. Some microlenders are non-profit organizations that have global reach but not all. The Small Business Administration provides microloans through a local intermediaries. These are local community-based organizations that have their own lending and credit requirements. Typically, some collateral is required, and the business owner must personally guarantee the loan. The allowable interest rate on a microloan is higher than on a regular SBA loan. The creditworthiness of the project is considered in the loan determination. Since SBA microloans are provided through a local microlender, the time it takes to move through the financing process will depend on that organization’s processes and work load. SBA’s allowable interest rate on microloans is higher than the allowable rate on loans over $50,000.

Public Loan Programs

Some state and local economic development organizations offer their own loan programs for businesses. An example would be Florida’s Emergency Bridge Loan program that can be activated by the Governor’s office to provide short term funds for businesses affected by natural disasters such as hurricanes. Other local jusridictions may have similar programs to improve property, incentivize business diversification or respond to a local disaster.

Crowd Funding

There are two basic types of crowdfunding: rewards-based (or donation) crowdfunding and equity crowdfunding. Rewards-based crowdfunding is where the funder receives something in exchange for his/her donation. The reward could be an item like a T-shirt or coffee mug or pre-purchase of a product. A variety of websites offer rewards-based crowdfunding, including Kickstarter, GoFundMe, and Indiegogo. With this form of crowdfunding, the business owner does not have to give up any equity and the money raised does not have to be repaid. Rewards-based crowdfunding works best when you have a compelling story and the ability to market the pitch. Through equity crowdfunding, early-stage ventures choose to raise funds by offering shares of the company in exchange for investment by multiple people. Projects must be administered through a firm registered with the SEC. The length of time involved in obtaining crowdfunding is directly related to the length of the campaign, which typically ranges from 30 to 60 days. Most reward-based crowdfunding sites keep a percentage of the money raised. This often ranges from 3-10% but can be higher.

Venture Capital

Venture capital is an equity-based form of funding. The entity providing funding will expect a share of the business that they invest in. Venture capital firms look for high rates of return with minimal risk and a clear exit strategy. They will perform significant due diligence to determine whether or not to invest so the process takes time. For a business to be attractive to a venture capital firm, the company must have some sort of unique competitive advantage or high-value technology (or both) along with a strong management team. Since venture capitalists are often investing sums in the millions, they take their time reviewing and screening prospects, on average two to six months. VCs often will ask for a 10-40% ownership stake, and company founders will be asked to yield some control of the company’s direction and governance.

Angel Investment

Angel investors are individuals who provide capital for business ventures and startups in need of funding. They are typically high net worth individuals willing to invest $50,000 to $1 million of their own money in high-potential business ventures (generally, early-stage businesses). Angels often target businesses in a specific industry or geographic area and business owners typically find angel investors through their own personal netwok. Angel investors will expect a sound business strategy that will help them obtain a good return on their investment. Angels can act quickly or, in the case of organized groups, more deliberately, so timing will vary. Most angel groups have multi-step review processes. Angels will expect a stake in the company. The earlier they invest and the more capital they invest, the larger their equity.

Public and Private Grants

Small business grants are available but have limited eligibility and are highly competitive. Existing small businesses may be eligible for government technology and innovation grants through the federal Small Business Innovation Research and Small Business Technology Transfer (SBIR/STTR) programs. However, such programs are very narrow in scope. Economic develop organizations and major corporations may also provide targeted grant programs to promote growth in targeted locations, industries or demograhic populations.

What Type of Funding Do You Need?

With so many funding options available now, choosing one that best fits your need can be a challenge. So let us help! We've configured a short list of questions that, when answered, can help narrow the options you'll want to consider. Just take a few seconds to answer the questions and see the result.

What type of funding are you seeking?

Will you provide collateral to back the loan?

Which growth stage listed below best describes your business today?

What amount of funding are you seeking?

How quickly will you need to have funds?

What will the funds be used for?

What is you FICO credit score?

Financial Management

Business leaders need a firm grasp on the financial state of their venture to make both sound and timely decisions. They must know how funds are being used and whether there are sufficient resources to sustain their vision and strategy going forward. Without effective financial management, even viable, high potential businesses could ultimately fail.

This guide has been developed to help those with limited business finance experience improve financial awareness and perhaps, business effectiveness. It will cover several areas of financial management including:

- Language of Money (glossary)

- Financial Statements

- Budgeting

- Financial Projections

- Cash Flow Management

- Business Debt

LANGUAGE OF MONEY

For those not formally trained in accounting, there are terms you will need to know to effectively manage business finances. The more commonly used terms are explained below.

Accounts Payable: Accounts payable represent your business’s obligation to pay debts owed to lenders, suppliers, and creditors. Sometimes referred to as A/P or AP for short, accounts payable can be short or long-term depending upon the type of credit provided to the business by the lender.

Accounts Receivable: Also known as A/R, accounts receivable is the money owed to your small business by others for goods or services rendered. These accounts are labeled as assets because they represent a legal obligation for the customer to pay you cash for their short-term debt.

Accruals: A business finance term and definition referring to expenses that have been incurred but haven’t yet been recorded in the business books. Wages and payroll taxes are common examples.

Asset: Any item of economic value owned by an individual or corporation, especially that which could be converted to cash. Examples are cash, securities, accounts receivable, inventory, office equipment, a house, a car, and other property.

Balance Sheet: A structured listing of an entity’s Assets, Liabilities and Equity (net worth) at a specific time. Assets = Liabilities + Equity.

Break-even Analysis: A calculation of the approximate sales volume required to just cover costs, below which production would be unprofitable and above which it would be profitable. Break-even analysis focuses on the relationship between fixed cost, variable cost and profit.

Budget: A relatively detailed list of costs and revenues projected for a future period of time, typically 1 year. A budget is mostly derived from current-year data plus some portion that is forecast or projected. Budgets provide a means to track financial performance (versus expectations) and to gauge timing for investment in areas such as staffing, capital equipment, supplies and inventory.

Cash Flow: The net balance of cash moving into and out of a business at a specific point in time. Positive cash flow means a company has more money moving into it than out of it. Negative cash flow indicates a company has more money moving out of it than into it.

Cash Conversion Cycle: A working capital metric that shows the average time from the point cash is used to purchase inventory until it’s collected after goods are provided and payment is received.

Cost-of-Goods Sold: This is a total of both variable indirect and direct costs associated with a product or good that is sold. It includes labor cost, material costs, consumable supply expense and more.

Collateral: Assets pledged by a borrower to secure a loan or other credit, and subject to seizure in the event of default. The more common forms of collateral real estate, capital equipment and vehicles.

Current Assets: A balance sheet item which equals the sum of cash and cash equivalents, accounts receivable, inventory, marketable securities, prepaid expenses, and other assets that could be converted to cash in less than one year.

Current Liabilities: A balance sheet item, which equals the sum of all money owed by a company and due within one year.

Days Payable: A measure of the average time a company takes to pay vendors, equal to accounts payable divided by annual credit purchases times 365.

Days Receivable: A measure of the average time a company's customers take to pay for purchases, equal to accounts receivable divided by annual sales on credit times 365.

Depreciation: A non-cash operating expense that reduces the value of a tangible asset as a result of wear and tear, age, or obsolescence. Depreciation is recorded in the financial statements of an entity as a reduction in the carrying value of the asset in the balance sheet and as an expense in the income statement.

Income Statement: A structured listing showing all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions. (similar to a Profit & Loss Statement).

Intangible Asset: A business asset that is non-physical is considered intangible. These assets can be items like patents, goodwill, and intellectual property.

Liabilities: A financial obligation, debt, or claim, i.e. notes payable and accounts payable.

Lien: A legal claim against an asset which is used to secure a loan, and which must be paid when the property is sold.

P&L (Profit and Loss Statement): Also considered an Income Statement or Statement of Earnings. A structured listing that measures Net Income (or loss) over a defined period using the formula, Revenues – Expenses = Net Income/Loss.

Proforma Statement(s): These are forward-looking financial reports, including income statements, cash flow statements and balance sheets, that are developed using assumptions or hypothetical conditions about events that may have occurred in the past or which may occur in the future. One of the most important uses of pro forma reports is to provide context for decision-making and strategic planning efforts.

Shareholder Equity: If you have chosen to fund your small business with equity financing and you have established shares and shareholders as part of the controlling interests, you are obligated to provide a financial report that shows changes in the equity section of your balance sheet.

Working Capital: The amount of current assets that is left after all current debts are paid. Working capital represents the cash and cash equivalents available to meet short-term obligations, such as unpaid taxes and short-term debt.

To see a full list of financial terminology common to businesses, go to Investopedia’s Dictionary of Business Financial Terms.

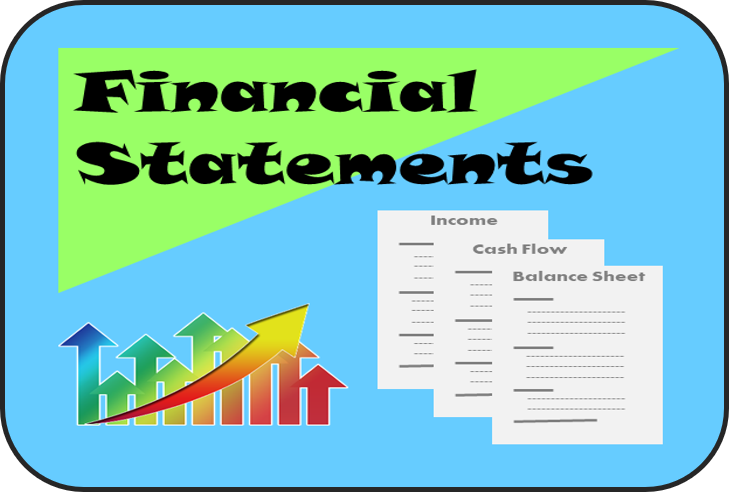

FINANCIAL STATEMENTS

There are three primary financial statements that are needed for keeping track of money and profitability. They include Income Statement, Balance Sheet, and Cash Flow Statement. All three are related but differ in time, purpose, and core metrics. In the table below you can see how these three primary business financial statements differ.

Financial Statement Comparison

| Income Statement | Balance Sheet | Cash Flow | |

| Time Frame | selected period | point in time | selected period |

| Purpose | profitability | financial position | cash movements |

| Measures | revenue, expense, profit or loss | assets, liabilities and shareholder equity | cash increase and decrease |

| Beginning Line | revenue | cash balance | revenue |

| Bottom Line | net income | retained earnings | ending cash balance |

INCOME STATEMENT

Income Statement (P&L) An income statement is a report that shows whether a company was profitable over a specific period (usually for one year or some portion of a year). The statement shows revenue and the costs associated with generating that period’s income. The literal “bottom line” of the statement usually shows the company’s net earnings or losses. This tells you how much the company earned or lost over the period covered.

Income statements also report earnings per share (or “EPS”). This calculation tells you how much money shareholders would receive if the company decided to distribute all the net earnings for the period. (Companies almost never distribute all earnings. They usually reinvest them in the business.)

To understand how income statements are set up, think of them as a set of stairs. You start at the top with the total value of sales made during the accounting period. Then you go down, one step at a time. At each step, you make a deduction for certain costs or other operating expenses associated with earning the revenue. At the bottom of the stairs, after deducting all of the expenses, you learn how much the company actually earned or lost during the accounting period. People often call this “the bottom line.”

At the top of each income statement is the total amount of money brought in from sales of products or services. This top line is often referred to as gross revenues or sales. It’s called “gross” because expenses have not been deducted from it yet.

The next line is money the company doesn’t expect to collect on certain sales. This could be due, for example, to sales discounts or merchandise returns.

When you subtract the returns and allowances from the gross revenues, you arrive at the company’s net revenues. It’s called “net” because, if you can imagine a net, these revenues are left in the net after the deductions for returns and allowances have come out.

Below the net revenue line are several lines that represent various kinds of operating expenses. Although these lines can be reported in various orders, the next line after net revenues typically shows the costs of the sales. This number tells you the amount of money the company spent to produce the goods or services it sold during the accounting period.

The next line subtracts the costs of sales from the net revenues to arrive at a subtotal called “gross profit” or sometimes “gross margin.” It’s considered “gross” because there are certain expenses that haven’t been deducted from it yet.

The next section deals with operating expenses. These are expenses that go toward supporting a company’s operations for a given period – for example, salaries of administrative personnel and costs of researching new products. Marketing expenses are another example. Operating expenses are different from “costs of sales,” which were deducted above, because operating expenses cannot be linked directly to the production of the products or services being sold.

Depreciation is also deducted from gross profit. Depreciation takes into account the wear and tear on some assets, such as machinery, tools and furniture, which are used over the long term. Companies spread the cost of these assets over the periods they are used. This process of spreading these costs is called depreciation or amortization. The “charge” for using these assets during the period is a fraction of the original cost of the assets.

After all operating expenses are deducted from gross profit, you arrive at operating profit before interest and income tax expenses. This is often called “income from operations.”

Next companies must account for interest income and interest expense. Interest income is the money companies make from keeping their cash in interest-bearing savings accounts, money market funds and the like. On the other hand, interest expense is the money companies paid in interest for money they borrow. Some income statements show interest income and interest expense separately. Some income statements combine the two numbers. The interest income and expense are then added or subtracted from the operating profits to arrive at operating profit before income tax.

Finally, income tax is deducted, and you arrive at the bottom line: net profit or net losses. (Net profit is also called net income or net earnings.) This tells you how much the company actually earned or lost during the accounting period. Did the company make a profit, or did it lose money?

See a sample income statement here.

BALANCE SHEET

Balance Sheet - A balance sheet summarizes your assets and liabilities at the close of business on the last day of a profit period and reports the sources of your owners’ equity. It helps you understand how much money your business has (assets), how much you owe (liabilities), and how much equity owners have in your company.

Assets are things that a company owns that have value. This typically means they can either be sold or used by the company to make products or provide services that can be sold. Assets include physical property, such as plants, trucks, equipment, and inventory. It also includes things that can’t be touched but nevertheless exist and have value, such as trademarks and patents. And cash itself is an asset. So are investments a company makes.

Liabilities are amounts of money that a company owes to others. This can include all kinds of obligations, like money borrowed from a bank to launch a new product, rent for use of a building, money owed to suppliers for materials, payroll a company owes to its employees, environmental cleanup costs, or taxes owed to the government. Liabilities also include obligations to provide goods or services to customers in the future.

Shareholders’ equity is sometimes called capital or net worth. It’s the money that would be left if a company sold all of its assets and paid off all of its liabilities. This leftover money belongs to the shareholders, or the owners of the company.

Balance Sheet Formula: ASSETS = LIABILITIES + SHAREHOLDER EQUITY

A company’s balance sheet is set up like the basic accounting equation shown above. On the left side of the balance sheet, companies list their assets. On the right side, they list their liabilities and shareholders’ equity. Sometimes balance sheets show assets at the top, followed by liabilities, with shareholders’ equity at the bottom.

Assets are generally listed based on how quickly they will be converted into cash. Current assets are things a company expects to convert to cash within one year. A good example is inventory. Most companies expect to sell their inventory for cash within one year. Noncurrent assets are things a company does not expect to convert to cash within one year or that would take longer than one year to sell. Noncurrent assets include fixed assets. Fixed assets are those assets used to operate the business but that are not available for sale, such as trucks, office furniture and other property.

Liabilities are generally listed based on their due dates. Liabilities are said to be either current or long-term. Current liabilities are obligations a company expects to pay off within the year. Long-term liabilities are obligations due more than one year away.

Shareholders’ equity is the amount owners invested in the company’s stock plus or minus the company’s earnings or losses since inception. Sometimes companies distribute earnings, instead of retaining them. These distributions are called dividends.

A balance sheet shows a snapshot of a company’s assets, liabilities and shareholders’ equity at the end of the reporting period. It does not show the flows into and out of the accounts during the period.

See a sample balance sheet here.

CASH FLOW STATEMENT

Cash Flow Statement – This is one of the most important business records for gauging financial health. A cash flow statement shows changes over time rather than absolute dollar amounts at a point in time. It uses and reorders the information from a company’s balance sheet and income statement.

The bottom line of the cash flow statement shows the net increase or decrease in cash for the period. Generally, cash flow statements are divided into three main parts. Each part reviews the cash flow from one of three types of activities: (1) operating activities; (2) investing activities; and (3) financing activities.

Operating Activities

The first part of a cash flow statement analyzes a company’s cash flow from net income or losses. For most companies, this section of the cash flow statement reconciles the net income (as shown on the income statement) to the actual cash the company received from or used in its operating activities. To do this, it adjusts net income for any non-cash items (such as adding back depreciation expenses) and adjusts for any cash that was used or provided by other operating assets and liabilities.

Investing Activities

The second part of a cash flow statement shows the cash flow from all investing activities, which generally include purchases or sales of long-term assets, such as property, plant and equipment, as well as investment securities. If a company buys a piece of machinery, the cash flow statement would reflect this activity as a cash outflow from investing activities because it used cash. If the company decided to sell off some investments from an investment portfolio, the proceeds from the sales would show up as a cash inflow from investing activities because it provided cash.

Financing Activities

The third part of a cash flow statement shows the cash flow from all financing activities. Typical sources of cash flow include cash raised by selling stocks and bonds or borrowing from banks. Likewise, paying back a bank loan would show up as a use of cash flow.

While an income statement can’t tell you whether a company made a profit, a cash flow statement can tell you whether the company generated enough revenue to cover expenses. This is particularly important for ventures just getting started or seasonal businesses where just a few months generate most of the company’s annual sales. See a sample cash flow statement here.

BUDGETING

Operating budgets are forward-looking documents that help business owners recognize current financial realities and establish near-term spending and revenue plans. According to leadership expert John C. Maxwell: “A budget is telling your money where to go instead of wondering where it went.”

Once a budget is created, it can then be used to track business financial performance through what are called variance reports. These reports can help identify excess spending, revenue shortfalls and changes in both material and labor costs. They provide a timely “check” on the alignment of original expectations and current reality.

The four major elements of budgeting are:

1. Understanding Your Organization’s Goals

Before you compile your budget, it’s important to have a firm understanding of the goals your organization is working toward for the period covered. These goals should be documented and well communicated to each member of the company’s team. Starting in this way, the budget will align with the organization’s priorities and facilitate help support their achievement.

2. Estimating Your Income for the Period Covered by the Budget

Answer the question, “will my company’s income be appreciably different than the previous year?” If not, where customers are locked into multi-year agreements for example, use last year’s data with minor adjustments. If yes, for example with new products to be introduced, you’ll need to model sales after your growth plan.

3. Identifying Your Expenses

Once you understand your projected income for the period, you need to estimate your expenses. This process involves three main categories: fixed costs, variable expenses, and one-time expenses.

Fixed costs are any expenses that remain constant over time, like a long-term lease payment.

Variable expenses are those that change over time depending on several factors, including production and sales activities. These include supplies, services and staffing-related costs.

One-time expenses, also called “one-time spends” are those that don’t recur and typically happen infrequently. Purchasing equipment or facilities, developing a new product or service, and hiring a consultant are all examples of one-time expenses.

4. Tracking Budget Surplus or Deficit

After creating a budget, and with business activity going forward, periodically compare actual cost and revenue to the budget plan and calculate gross profit for that period of time. If positive, carry the surplus forward or invest in areas of need. If negative, adjust spending or revise revenue generating tactics.

Revenue from Operations

To create a budget, first estimate and summarize the business revenue expected for the period covered (month, quarter, or year). By starting with revenue, you provide a basis for the next step in the budgeting process, defining expenses associated with the product or service you sell.

If you’re an established business, start with the question, “will my company’s income significantly differ from the previous year?” If customers have multi-year purchase agreements or sales come from stable and mature markets, you can probably use last year’s data with only minor adjustments. But, if you expect big changes in revenue, with the introduction of new products or entry into new markets, you’ll need to model sales after your business’s growth plan.

Operating Costs/Expenses

When creating an operating expense budget, you will need to recognize and segregate costs that are fixed, variable and those that are non-recurring.

Fixed costs are those that don’t change with sales activity like rent, insurance, licenses, or real estate taxes.

Non-recurring or “one time” costs are those that pop up now and then like, new equipment purchase, an unplanned maintenance event or attending a conference.

Variable costs are those that do change with time or sales activity like utilities, supplies, shipping expense, product material costs and staffing-related expense. Some examples of variable cost include:

- Cost of goods/inventory (material + labor + activity-based overhead)

- Equipment

- Software

- Rent and utilities

- Phone and communication services

- Marketing and advertising costs

- Office supplies, shipping and postage

- Furniture

- Subscriptions

- Legal fees

- Maintenance and repairs

- Meals

- Transportation expenses

- Insurance

- Indirect staffing

- Employee benefits

- Acts of generosity to your team, customers, and community

Profit/Loss Estimate

With revenue and expense budgets complete, you can now see whether your business will generate a profit or loss in the period you’re projecting. This is why budgets are important. They let owners see whether the plans made are good “as is” or they require adjustment to meet financial goals.

It is best to first complete a gross profit calculation which is subtracting cost-of-goods sold from gross revenue. Your gross profit margin should be greater than indirect variable expenses, fixed costs and non-recurring costs that occur during the budget period. If gross profit is negative, you’re in big trouble and will need to explore the basis for the negative result.

Once gross profit is calculated, then net profit is determined by taking the gross profit result previously discussed and subtracting all remaining fixed, variable, and non-recurring expenses from it. The result of this calculation is your net profit. Again, if the result is not in line with expectations, adjustments to your operating plan will need to be made.

Finally, budgets are not only planning tools for achieving financial success, they can also be vigilance tools. By creating “budget versus actual” variance reports, businesses can see where spending and/or revenue have deviated from original expectations. Then, after investigation, resources can be re-allocated or expenses adjusted to get back on track.

To learn more and see a sample annual budget, go here. To learn more and see a sample budget variance report, go here.

FINANCIAL PROJECTIONS

Financial projections, called pro forma financial statements by many, are an important business planning tool for several reasons. If you’re starting a business, financial projections help you plan your startup budget, assess when you can expect the business to become profitable, and set benchmarks for achieving financial goals. If you're already in business, you may need pro forma financial statements to quantify the impact of potential business decisions, such as investing in capital equipment, developing new products or just taking out a loan.

Pro forma financial statements include projected balance sheets, income statements, and cash flow statements that lenders and potential investors often require. Pro forma statements can also provide you and your team a consensus outlook to consider before signing on the dotted line.

If there are considerable "unknowns" that may affect your projection, you may want to include a best-case and worst-case scenario to account for all possibilities. Make sure you know the assumptions behind your financial projections and can explain them to others.

Startup business owners often wonder how to create financial projections for a business that doesn’t exist yet. Financial projections are always educated guesses. To make yours as accurate as possible, do your homework and get help. Use the information you unearthed in researching your business plans, such as statistics from industry associations, data from government sources, and financials from similar businesses. An accountant with experience in your industry can be useful in fine-tuning your financial projections. So can business advisors such as SCORE mentors.

Once you complete your pro forma statements, don’t put them away and forget about them. Compare your projections to your actual financial statements on a regular basis to see how well your business is meeting your expectations. If your projections turn out to be too optimistic or too pessimistic, make the necessary adjustments to make them more accurate.

To learn more about pro forma financial statements, or to see an example, go here.

CASH FLOW MANAGEMENT

Cash flow management is the process of planning, tracking, and controlling the movement of cash in and out of a business with the goal of maintaining positive cash flow. It involves forecasting future cash needs and ensuring that there are sufficient funds available to meet these needs, as well as managing any excess cash in a way that maximizes its value. Cash flow management is an important aspect of financial planning and can help a business to stay financially stable and avoid financial challenges, such as bankruptcy or default on loans.

According to a U.S. Bank study, 82% of small businesses fail due to poor cash flow management or a misunderstanding of how it contributes to business continuity. To help avoid this fate:

- Develop timely and accurate financial statements, including cash flow statements.

- Perform monthly cash flow analyses and update forecasts as needed.

- Re-align expenses with business activity monthly.

- Optimize the timing of payments to accelerate and cash receipts and take advantage of early payment discounts.

Cash flow management is crucial for every enterprise as it supports day-to-day business operations, financial stability, growth, and enables strategic decision-making. Businesses that maintain a positive cash flow take advantage of new business ventures, thrive in a competitive environment, and successfully navigate financial challenges.

Practices that will help you optimize cash flow in your business include:

- Create cash flow statements and cash flow projections. Update them regularly.

- Invoice customers quickly once your product or service is delivered.

- Establish tracking system to manage outstanding (aged) invoices.

- Provide customers with the latest electronic payment options.

- Transfer/deposit business receipts daily.

- Take advantage of early payment discounts when offered.

- Pay your non-discounted bills when they’re due, not before.

- Establish a line of credit to mitigate extended cash conversion cycles.

- Invest your cash reserve when appropriate.

Learn more about cash flow management techniques at the links provided below.

BUSINESS DEBT

Debt is a necessary part of most business journeys. Businesses use debt to improve cash flow, pay suppliers, run payroll and more. Taking out loans or seeking financing can be an integral part of a sound business strategy. Debt is a tool that when used judiciously can help launch, sustain and grow a business. But debt that is acquired hastily and not managed properly can cause irreparable harm to any venture.

Proper use and management of debt starts with a clear view of a company’s financial situation. That means you have current financial budgets, profit/loss statements, a detailed balance sheet and cash flow statements. If needed, review [your] financials holistically with your CFO or a financial professional and discuss the company’s capacity to absorb principal and interest payments.

When planned well, debt can provide businesses with a source of growth funding that is more affordable than equity-based solutions. It can also give existing shareholders a means to increase financial returns by leveraging their initial investment without dilution. And debt can provide interest-based income tax savings under current tax law.

If debt has already become an unsustainable burden on your business, consider advice provided in a recent Forbes article by Melissa Houston. She offers five essential strategies that will help you conquer your business debt and take control of your financial future.

1. Identify your debts and prioritize them

To start paying off your business debt, you must first be aware of all your debts. Make a list of all your debts, including credit card debt, bank loans, and any other financial obligations you may have.

Then prioritize them based on their interest rates. High-interest rates debts should be a priority to pay off because they tend to accumulate more interest and become more challenging to pay off over time. Allocate your payments, concentrating on the highest interest-rate debts first.

2. Avoid taking on additional debt

This may seem obvious, but avoiding additional debt while trying to pay off existing ones is essential. Many businesses enter a cycle of borrowing to pay off old debt, which can significantly hinder your ability to pay down debts. Work on paying down your current debt with a consistent repayment plan, and avoid taking on additional debt whenever possible.

3. Renegotiate payments and interest rates

If you need help keeping up with your current repayment terms, contacting your creditors to renegotiate your payment terms or even interest rates is worthwhile. Many creditors are willing to work out a new payment plan with you to help you achieve your repayment goal. By doing so, you can make smaller payments and reduce some of the financial stress of your existing debt.

4. Optimize the profit in your business

The best way to pay off business debt is by optimizing profit within your business. Increasing your company's net profit margin will give you more funds to pay off outstanding debts. Profit can be achieved by tracking expenses, setting realistic goals, and allocating funds toward debt repayment. Paying off business debt can be feasible with a strategic approach, dedication, and perseverance.

5. Increase your revenue

When you have optimized your business for profit, you have a powerful tool. By increasing your revenue, you can start chipping away at any outstanding debts and move closer to achieving financial stability. Whether investing in marketing campaigns, developing new products, or improving your customer service, generating more sales is critical to achieving your financial goals. With determination and a strategic plan, you'll be surprised at how quickly you can start paying off those debts and build a stronger foundation for your business.

The bottom line is that paying off business debt can be a challenging task, but it's not impossible. You'll be on your way to debt-free business operations by implementing these five essential strategies. Taking control of your debt will set your company up for long-term financial success and stability.

Learn more about managing your business debt by visiting the National Foundation for Credit Counseling website.

The resources listed here contain links to third party websites not owned or operated by the County of Volusia. These external links are provided for informational purposes only and do not constitute endorsements by the County.

BUSINESS FUNDING OVERVIEW VIDEO

Ready to continue on the path to funding readiness? To log in, please fill out the form with the information you used to register your account:

Your personal contact information will not be sold or utilized for advertisement, solicitation, or promotion.

We're glad to see you are interested in our Readiness Checkup! Before you begin, we ask you to create an account. This allows you to save your progress, email copies, and view all of our informational videos! Simply fill out the form below to begin:

Your personal contact information will not be sold or utilized for advertisement, solicitation, or promotion.